Strategies for Cost-Effective Offshore Company Development

When taking into consideration overseas firm formation, the pursuit for cost-effectiveness ends up being a vital worry for companies looking for to increase their procedures globally. offshore company formation. By exploring nuanced methods that mix legal conformity, economic optimization, and technical developments, companies can get started on a path towards offshore company formation that is both economically prudent and tactically audio.

Selecting the Right Jurisdiction

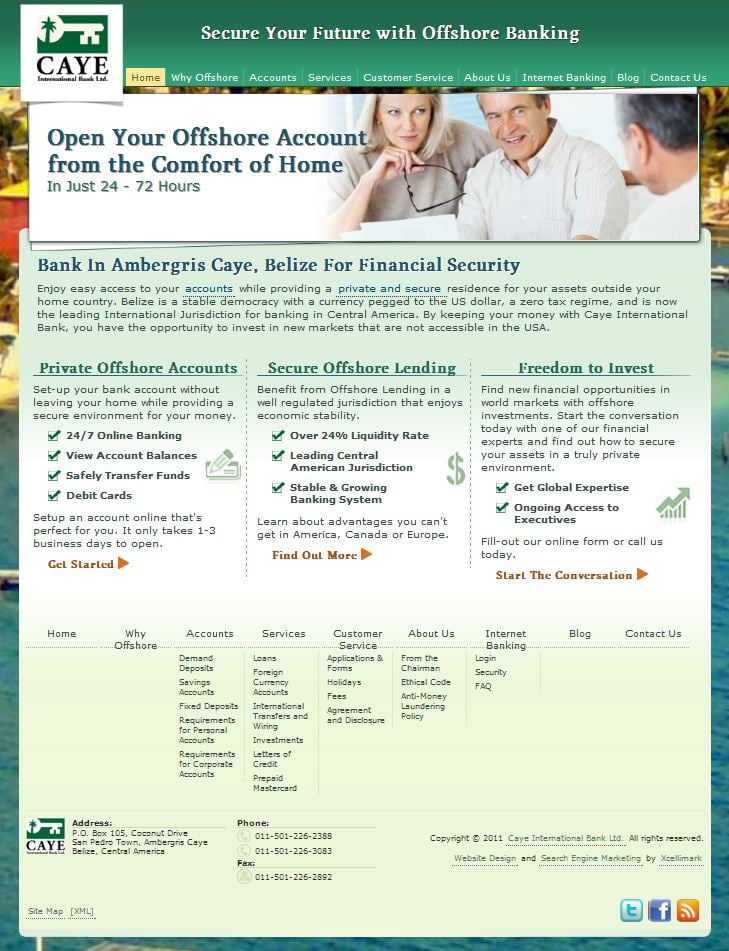

When establishing an overseas company, selecting the appropriate jurisdiction is a vital decision that can significantly impact the success and cost-effectiveness of the development process. The jurisdiction selected will certainly establish the regulatory structure within which the company operates, affecting taxation, reporting requirements, personal privacy regulations, and overall business adaptability.

When choosing a territory for your offshore company, numerous aspects have to be thought about to make certain the decision lines up with your strategic goals. One crucial aspect is the tax obligation regimen of the jurisdiction, as it can have a significant effect on the business's earnings. Additionally, the level of regulative compliance required, the political and financial security of the jurisdiction, and the convenience of doing service should all be reviewed.

Additionally, the online reputation of the jurisdiction in the international service community is important, as it can influence the understanding of your company by customers, companions, and banks - offshore company formation. By carefully evaluating these elements and looking for professional guidance, you can choose the best territory for your overseas company that enhances cost-effectiveness and supports your company objectives

Structuring Your Business Effectively

To guarantee optimum efficiency in structuring your overseas firm, meticulous interest has to be given to the organizational structure. By developing a transparent ownership framework, you can make certain smooth decision-making processes and clear lines of authority within the business.

Next, it is important to think about the tax obligation effects of the picked structure. Various jurisdictions provide varying tax benefits and motivations for overseas business. By very carefully analyzing the tax obligation regulations and policies of the selected jurisdiction, you can optimize your company's tax effectiveness and lessen unneeded expenses.

Furthermore, preserving appropriate documentation and documents is important for the effective structuring of your offshore firm. By maintaining current and exact records of financial deals, business choices, and compliance documents, you can ensure transparency and responsibility within the organization. This not only helps with smooth operations but also aids in demonstrating compliance with regulative needs.

Leveraging Innovation for Financial Savings

Effective structuring of your offshore company not only pivots on careful focus to organizational structures but also on leveraging modern technology for cost savings. One means to utilize innovation for cost savings in overseas firm development is by using cloud-based services for information storage and partnership. By incorporating innovation purposefully right into your offshore company development procedure, you can achieve considerable savings while improving operational performance.

Lessening Tax Responsibilities

Using tactical tax obligation planning techniques can properly lower the economic worry of tax liabilities for overseas business. Among the most common methods for lessening tax responsibilities is via revenue shifting. By dispersing earnings to entities in low-tax territories, offshore firms can lawfully lower their overall tax responsibilities. Additionally, taking benefit of tax obligation motivations and exemptions used by the territory where the offshore firm is signed up can result in significant savings.

An additional method to reducing tax responsibilities is by structuring the overseas company in a tax-efficient fashion next page - offshore Check This Out company formation. This includes very carefully making the ownership and functional framework to maximize tax obligation advantages. Setting up a holding business in a territory with beneficial tax obligation laws can assist combine earnings and reduce tax obligation exposure.

Moreover, staying updated on global tax obligation guidelines and conformity needs is vital for lowering tax obligation obligations. By ensuring rigorous adherence to tax obligation laws and regulations, overseas business can stay clear of expensive fines and tax disagreements. Looking for expert recommendations from tax consultants or lawful experts specialized in international tax obligation issues can additionally give useful understandings into effective tax obligation preparation strategies.

Making Sure Compliance and Risk Mitigation

Applying robust compliance steps is necessary for offshore firms to reduce dangers and preserve regulative adherence. Offshore jurisdictions typically face raised examination as a result of issues relating to money laundering, tax evasion, and other financial criminal activities. To guarantee compliance and alleviate risks, offshore companies should perform thorough due diligence on clients and service partners to avoid involvement in immoral activities. In addition, executing Know Your Consumer (KYC) and Anti-Money Laundering (AML) treatments can assist confirm the authenticity of transactions and secure the business's reputation. Regular audits and evaluations of monetary records are critical to recognize any irregularities or non-compliance concerns without delay.

Moreover, remaining abreast of transforming policies and legal requirements is vital for offshore business to adapt their conformity practices accordingly. Involving lawful experts or conformity consultants can supply important guidance on browsing complicated governing landscapes and guaranteeing adherence to global standards. By focusing on compliance and risk mitigation, overseas companies can improve transparency, develop depend on with stakeholders, and secure their operations from potential lawful repercussions.

Final Thought

Using critical tax planning strategies can properly minimize the economic problem of tax obligations for overseas firms. By click to investigate distributing revenues to entities in low-tax jurisdictions, offshore firms can lawfully reduce their total tax obligation obligations. In addition, taking benefit of tax obligation incentives and exemptions provided by the jurisdiction where the offshore company is registered can result in considerable cost savings.

By making certain rigorous adherence to tax obligation legislations and regulations, offshore business can stay clear of pricey charges and tax disagreements.In final thought, affordable offshore company development needs mindful factor to consider of jurisdiction, reliable structuring, modern technology use, tax minimization, and conformity.